IRD Interest rates

There are certain topics that we enjoy being cynical about. The speed at which oil companies increase their price at the pump when the price of crude increases versus the speed at which it drops when the price of crude decreases. Or similarly, how quickly banks increase interest rates when the OCR increases, versus reducing it for OCR decreases.

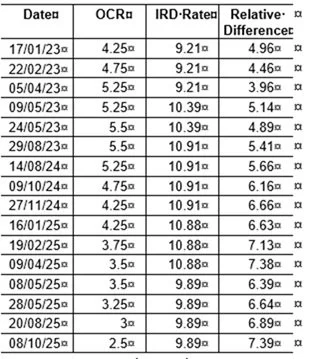

Could it be time to add the IRD to the above list? The table below summarises the movements in the OCR over the last few years and compares those movements to the interest rate charged by IRD. It is generally understood that IRD does not wish to be treated as a bank; therefore, there is a large variance between the debit and credit rates. However, given the punitive nature of the debit rate charged, it is reasonable to expect more timely reductions in the rate.