Fringe Benefit Tax proposals - the death of the ute

On 1 April 2025, Inland Revenue released its issues paper ‘Fringe Benefit Tax - Options For Change’, proposing significant changes to the Fringe Benefit Tax (FBT) regime, which has been in place for 40 years. The Issues Paper sought feedback from the public on a number of proposed changes to the regime aimed at reducing compliance costs and simplifying the calculation and filing process.

One of the most notable of the proposed changes is the complete removal of the ‘work related vehicle’ concession. Instead, the amount of FBT payable on vehicles would be determined based on the way in which they are used, rather than their physical characteristics. Other proposed changes to motor vehicles are the removal of the tax book value method, emergency call exclusion, allowing vehicles used for emergency services to be exempt from FBT at all times and allowing incidental use of pool vehicles.

New rates are also proposed for calculating the taxable value of a vehicle benefit. The current per annum rate is 20%. The proposed per annum rates are:

Petrol / Diesel vehicles: 26%

Hybrid vehicles: 22.4%

Electric vehicles: 19.4%

Three categories of vehicle use are proposed:

Category 1: predominantly available for unrestricted private use (100%).

Category 2: predominantly business use with restricted private use, home to work only (35%).

Category 3: business use only, with no personal use other than driving to multiple worksites (no private use).

Categories 2 and 3 are considered similar, with one of the distinctions being whether the employee is usually travelling to the same workplace (category 2), e.g., a fixed office each day, or if they are regularly going to different workplaces (category 3). The logic for the difference is that if an employee has a fixed place of work, the home to work travel is of a private nature, whereas a more itinerant employee (like a builder or a plumber) is travelling “on work” when they leave for their first job location.

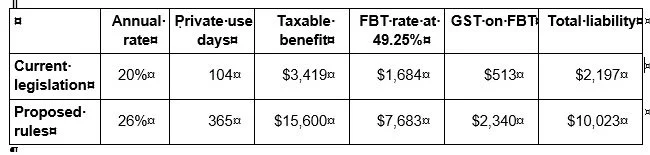

To illustrate the effect, we have prepared a before and after comparison table below for a ute based on the following facts: a cost of $60k + GST, provided to an employee with a salary of $80k, qualifies as a work-related vehicle, and use is restricted to home to work travel on Monday to Friday, but fully available on weekends. Due to the availability on weekends, it would appear that the ute falls into category 1.

We are at an early stage in the consultation process with draft legislation still to come, but there has been ‘noise’ around Inland Revenue’s view of the FBT treatment of utes for years. This could be the start of the end of the current concessionary methodology.